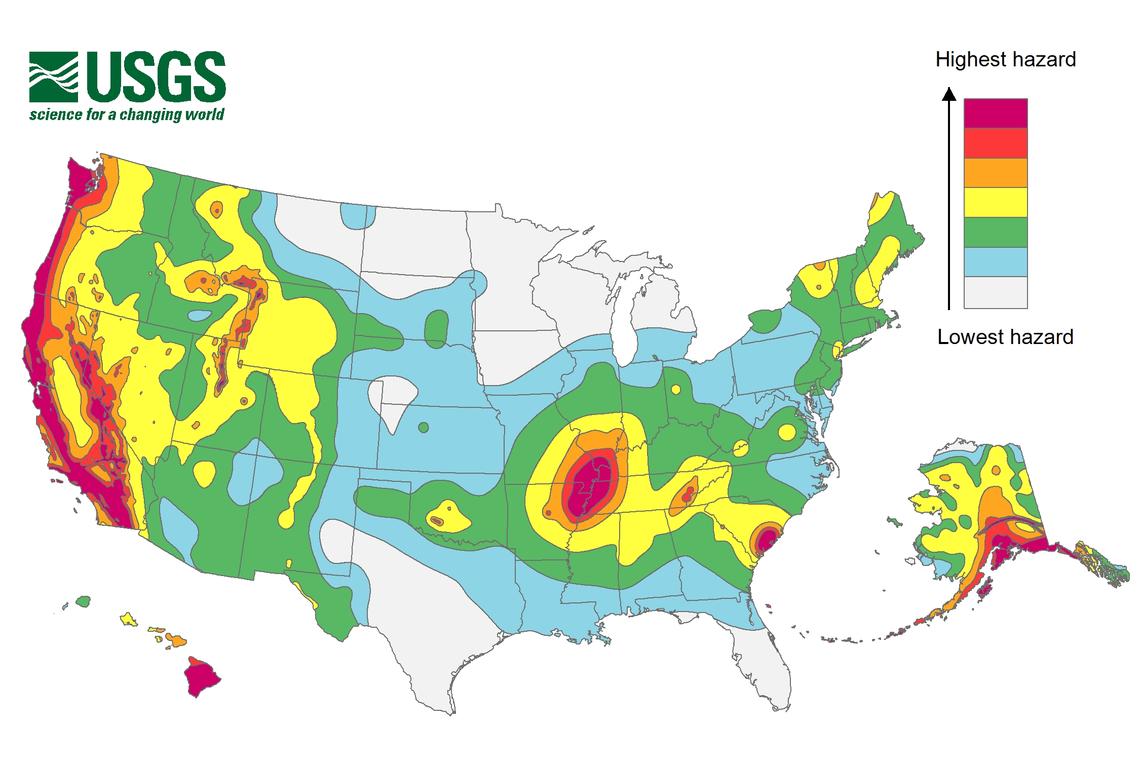

When you own a home in an earthquake hazard zone, consider how earthquake insurance can protect your financial security. You’ll want GeoVera on your side when the next earthquake strikes.

Is earthquake insurance worth it in California?

While no one can predict when and where the next big earthquake will strike, you can protect your financial security now with earthquake insurance.

To clarify, there are several factors to consider when determining if earthquake insurance is worth it for you.

First, do you own a home in an area prone to seismic activity?

Second, can you afford to rebuild without earthquake insurance?

Next, can you afford to replace your contents and personal property?

If your home and neighborhood are uninhabitable, could you manage to find a safe place to live?

Above all, do you want to risk losing your hard-earned equity in an instant?