Hurricane Ian is possibily the costliest storm in Florida history

As the impact of Hurricane Ian unfolds, industry estimates are northwards of $60 billion in property damage and possibly the costliest storm in Florida history.

Unfortunately, 82% of Florida homeowners do not have flood insurance, and most will be financially ruined due to the massive inland flooding caused by Hurricane Ian.

If only every Florida homeowner had purchased a flood insurance policy, they could afford to rebuild quickly.

California homeowners should take note

Now is the time to review your insurance coverage, and beware of coverage gaps for known risks and perils in your region.

For California, this means every homeowner should have earthquake insurance.

California's earthquake risk is growing

Urban sprawl, coupled with recent scientific research, is uncovering evidence that indicates earthquake risk is growing for California homeowners, and most do not have earthquake insurance.

Mark Ghilarducci, Director of the Governor’s Office of Emergency Services in California, says,

“A major earthquake would be devastating to California in damage and lives lost but given the state’s significant economic influence, the catastrophic impact would also reverberate across the nation and throughout the world.”

And this – according to FEMA:

“Recent earthquakes show a pattern of steadily increasing damages and losses, and California has the nation’s highest losses in property damage due to earthquakes.”

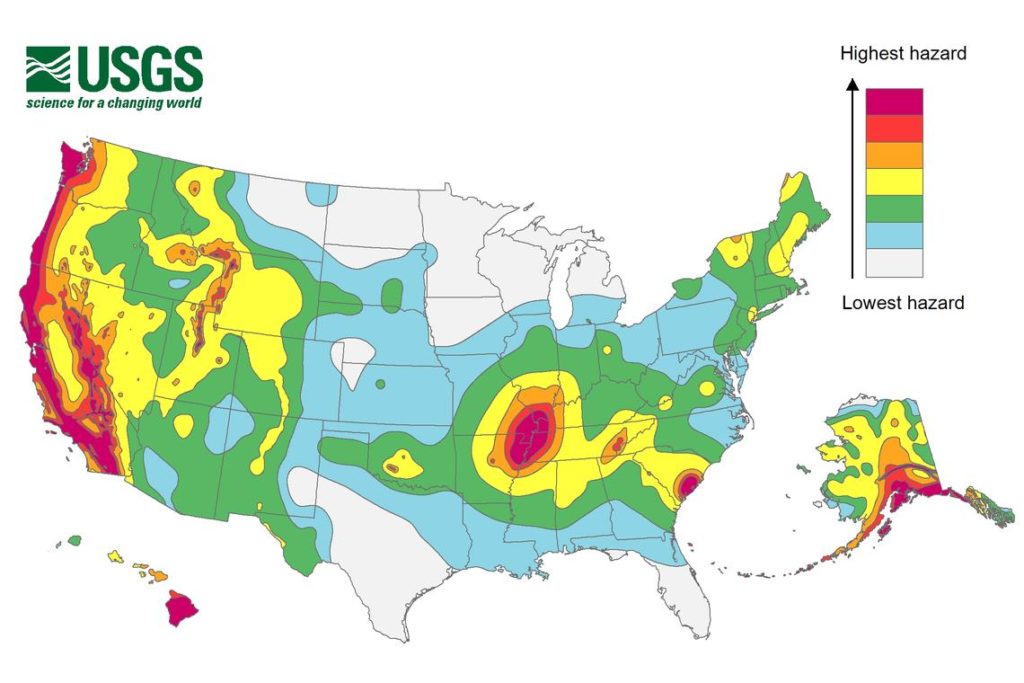

What is the EQ risk in your region?

When it comes to earthquakes, no one is risk-free in California. Scientists agree that there is more than a 99 percent chance of one or more major earthquakes striking California within 30 years of 2014.

Plus, recent research reveals evidence of increased risk in all regions of California. If you own a home in California, then keep reading.

Southern California EQ Risk:

If you knew your home was sitting on top of a fault system capable of producing a 7.8 magnitude earthquake, would you buy earthquake insurance before it happens?

The Los Angeles Times reports the Palos Verdes fault zone runs beneath numerous neighborhoods as well as the ports of Long Beach and L.A, is capable of a far more powerful quake than was previously known.

Central California EQ Risk:

Is Central California creeping closer to the “Big One”? San Andreas Fault’s creeping section could unleash large earthquakes.

The “Big One” is a real threat to both Southern and Northern Californians, but new research suggests that Central California also has the potential to experience larger devastating quakes.

Live Science: The central section of the San Andreas Fault could host larger quakes than previously realized

Northern California EQ Risk:

If you own a home in or near Silicon Valley, you might be sitting on top of a ticking time-bomb – the Foothill Thrust Belt faults.

Scientists at Stanford are warning about the possibility of an earthquake as big as Loma Prieta, on a fault under Silicon Valley.

- NBC Bay Area: Stanford Study Reveals New Fault Lines Near Bay Area

- San Francisco Chronicle: Bay Area’s next big earthquake might be on Silicon Valley fault

Are you prepared for an earthquake?

Scientists warn a massive earthquake can strike California at any moment. Today, an estimated 7.0 magnitude earthquake could displace over 150,000 people and cause billions of dollars in property damage.

The risk of earthquakes and their financial toll should be top of mind for every homeowner in California.

Did you know that your homeowners insurance policy does not provide coverage for earthquake damage?

Standard homeowners insurance policies do not cover earthquake damage, and FEMA grants don’t take the place of earthquake insurance. As a result, most people are not financially able to bear the loss of a home, rebuild that home, and still pay off their mortgage at the same time.

In fact, California has the highest amount of property damage losses due to earthquakes in the United States.

According to the California Department of Conservation, California generally gets two or three earthquakes per year large enough to cause damage to structures (magnitude 5.5 and higher).

If you experience a total loss in an earthquake, can you afford to rebuild, replace your belongings, find another place to live, and pay off your existing loans?

GeoVera’s smart earthquake insurance for homeowners will cover your dwelling, plus you can get coverage for your other structures, your contents, loss assessment, loss of use and more.

Why Choose GeoVera?

GeoVera is also California’s longest-tenured earthquake insurance provider and has the most advanced, mobile-friendly tools for policy management and claims reporting.

Speaking of claims, GeoVera has the best catastrophe claims team in the industry. Our claims professionals are dedicated to helping our customers rebuild quickly, in their greatest time of need.

We are experts at managing massive catastrophe losses during natural disasters. You’ll want GeoVera on your side when the next quake strikes.

With our convenient payment plans, you will find a price you can afford. Ask your insurance agent for a quote today, or visit GeoVera.