FEMA Home Repair Grant Eligibility and Earthquake Damage: What Homeowners Should Know

Earthquakes can cause serious damage to your home—and serious confusion about what help is available. Homeowners often mistakenly assume that federal aid will step in to cover the costs. While FEMA (Federal Emergency Management Agency) home repair grants can provide financial assistance to individuals and families affected by natural disasters—including earthquakes—FEMA’s home repair grants often offer limited assistance and can have conditions and stipulations.

Here are five key things every homeowner should understand about what FEMA’s Individual Assistance program offers for earthquake recovery—and why earthquake insurance remains the most dependable way to safeguard your home and finances.

1. FEMA ASSISTANCE IS LIMITED

FEMA’s Individual Assistance Program helps people begin recovering after a disaster—but it’s not designed to fully rebuild or replace a home. In 2024, the program’s maximum assistance was capped at $87,200, with up to $43,600 available for housing-related needs and another $43,600 for other essentials like hazard mitigation and uninsured expenses.

While these funds can help with temporary lodging, basic repairs, and essential items, homeowners often face significant out-of-pocket costs to fully recover.

FEMA assistance is meant to supplement insurance, not replace it. Even though a homeowner can receive up to $87,200, according to The Daily Journal of The United States, the average FEMA grant awarded to homeowners through the Individual and Household Program (IHP) was much lower, at just $4,200.

2. YOU MUST LIVE IN A FEDERALLY DECLARED DISASTER AREA

To qualify for federal assistance after an earthquake, your area must first be declared a federal disaster by the president. If an earthquake doesn’t meet that threshold, federal aid may not be offered at all.

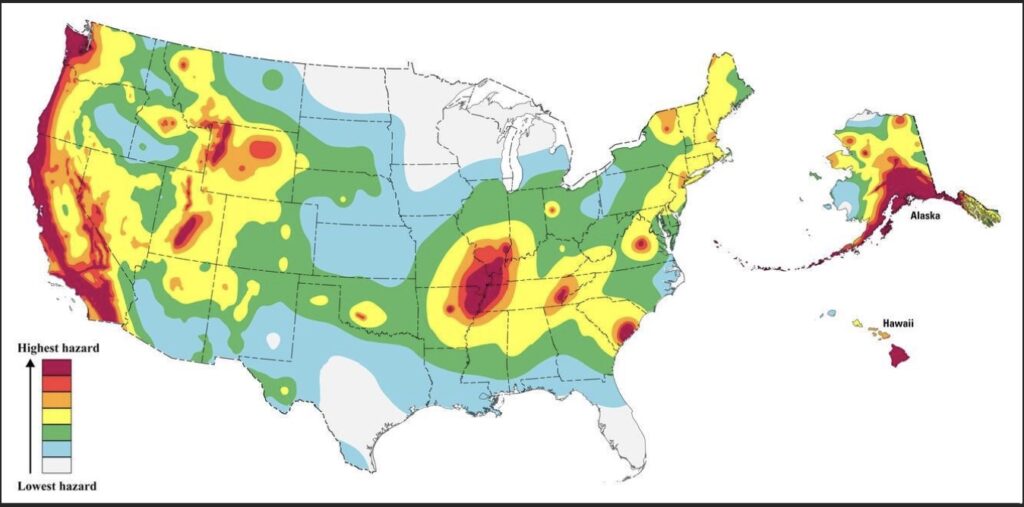

While earthquakes are most common along the West Coast, the U.S. Geological Survey (USGS) reports that nearly 75% of the US could experience a damaging earthquake. Although not every quake results in widespread destruction or qualifies for a federal disaster declaration, the risk of serious home damage is real—and often underestimated.

Earthquakes can leave lasting damage—cracked foundations, collapsed roof frames, burst pipes, and more. They can also trigger dangerous conditions like gas leaks, fires, and landslides. Yet despite the severity of the impact, federal help isn’t guaranteed to every homeowner.

3. YOU MUST APPLY AND QUALIFY

FEMA grants are not automatic. Homeowners must apply, and eligibility is determined on a case-by-case basis. These grants are need-based and intended to assist those who cannot afford essential recovery expenses through other means like insurance or personal savings.

Homeowners need to apply through FEMA, meet specific eligibility requirements, and provide documentation of property damage. In some cases, FEMA will inspect the property to determine the amount of assistance that will be provided.

Because the process can take some time, it’s important to register with FEMA as soon as possible after a disaster. You can learn more about applying for FEMA assistance on their website.

In some cases, insurance payments may arrive sooner than FEMA aid.

4. FEMA AID IS NOT MEANT TO REPLACE INSURANCE

FEMA grants typically provide a few thousand dollars—far less than the cost of rebuilding or major structural repairs. Even though a homeowner can receive up to $87,200, according to the Government Accountability Office, the average FEMA grant awarded to homeowners through the Individual and Household Program (IHP) was much lower, at just $4,200.

This data suggests that insurance can be a more reliable solution. Even FEMA encourages homeowners to financially prepare for earthquakes with proper coverage. As FEMA’s risk management guidance states: “While earthquakes cannot be predicted, what you do financially can be. Take proactive steps today by setting up a safety net you can rely on.”

With the potential for significant financial impact, homeowners are urged to understand the risks and take proactive steps to protect their property and peace of mind.

5. INSURANCE OFTEN UNLOCKS MORE AID

In addition to FEMA assistance, homeowners can choose from affordable earthquake insurance options to cover the cost of repairing or rebuilding their home.

Standard homeowners insurance policies do not cover earthquake damage. However, earthquake insurance, which is usually sold as a separate policy or as an endorsement to a homeowners insurance policy, is the reliable solution for protecting homes from earthquake-related damage.

Similar to standard homeowners insurance policies, earthquake insurance policies include a deductible. For example, if your policy has a $500,000 limit and a 10% deductible, and you suffer a total loss, your payout would be $450,000, not a dollar less.

In this scenario, even if FEMA awarded its maximum of $87,200, the homeowner would still face a $412,800 shortfall. That’s why FEMA assistance should not be viewed as a primary recovery resource—It’s designed to serve as a safety net, not a replacement for insurance.

If you have insurance but it doesn’t cover all earthquake-related damage, FEMA may help with certain uncovered expenses. In these cases, eligible homeowners may receive support from both their insurance provider and FEMA to help with recovery. Understanding how these resources complement each other can help when it comes to financial preparedness. Work with an insurance professional who can help you make decisions about how to best financially protect your home.

Ultimately, relying on FEMA alone isn’t enough. Earthquake insurance offers broader protection and greater peace of mind when disaster strikes.