GeoVera’s Transparent and Efficient Process

In the wake of an earthquake, the road to recovery can be challenging. Earthquake insurance serves as a critical safety net, providing financial relief and support. Understanding the process of filing and handling earthquake insurance claims is essential for a smooth and efficient resolution. Here, we outline the steps involved and offer guidance to ensure that policyholders are prepared and informed.

Preparation is Key

Before an earthquake strikes, it’s imperative to be prepared. Ensure that your insurance policy is up to date and accurately reflects the value of your property and personal items. Documenting your home and belongings with photos or videos can provide valuable evidence for your claim.

What else can you do to prepare your home for a seismic event?

Immediate Steps Post-Earthquake

After ensuring the safety of your family, pets, and loved ones, assess your home for damage. Contact your insurance provider as soon as possible to report a claim. GeoVera provides online claim reporting to begin the process. You may also call them directly at 800-631-6478. You’ll also need your policy number, so one idea is to save this information in your phone as a contact. Provide a detailed account of the damage and share any photographic evidence or receipts you have gathered.

In the meantime,

• Protect the property from further damage.

• Keep accurate records of all expenses, such as temporary repairs and additional living expenses.

• Report any burglary/theft claims to the appropriate authorities so there is a police report on file.

The Adjustment Process

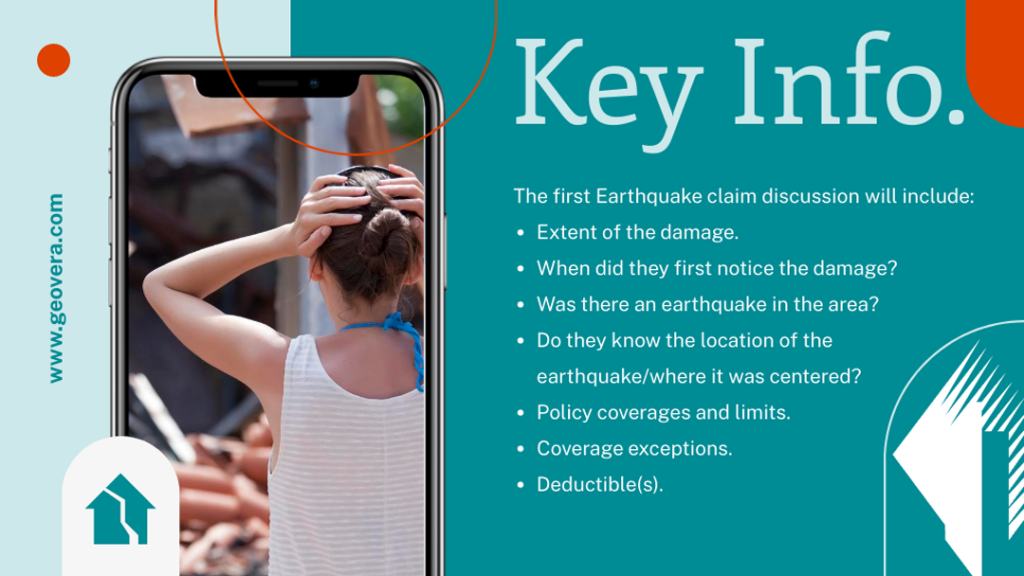

Once your claim is filed, it will be assigned to a GeoVera claims professional, who will make initial contact within one business day to review the claim details. GeoVera is proud to be the only major residential Earthquake insurance provider with an internal CAT (catastrophe) claims department. During the initial contact, the claims professional will discuss the following with the policyholder:

• Confirm the facts of the loss and gather additional information

• Review the applicable policy coverages, limits, and deductibles

• Determine the need for a field inspection and assign a field adjuster if needed

• Explain the claim handling process, including info about the field adjuster if one has been assigned

• Explain how to protect the property from further damage

• Outline any additional information or documentation necessary to resolve the claim

• Assisting in coordinating emergency housing should it be necessary

If the claim is assigned to a field adjuster, he/she will contact the policyholder directly to set up an appointment to conduct the inspection. All GeoVera adjusters are CEA-certified, ensuring expertise in handling earthquake-related claims. Their professional evaluation is crucial in determining the extent of the damage and the compensation you’ll receive. Be present during the inspection and discuss any concerns or questions you may have with the adjuster.

Documentation and Policy Details

Throughout the process, maintain thorough documentation. Keep records of all communications with your insurance company, receipts for any immediate repairs, and any additional expenses incurred due to the earthquake. This documentation will be invaluable in supporting your claim.

Familiarize yourself with the specifics of your earthquake insurance policy. Policies can vary significantly, and knowing what is covered, your deductible, and any exclusions will help manage your expectations and facilitate the claims process..

The Settlement

The claims professional will evaluate the claim based on the damages, policy coverage, and deductibles. If necessary, the claims professional will contact the appropriate parties to obtain any additional information needed to evaluate the damages. After the adjuster has assessed the damage, the insurance company will offer a settlement.

Earthquake insurance pays the insured for the claim amount minus the deductible amount without requiring the insured to have “spent” the money on the deductible yet. A couple of notes on GeoVera’s policy options:

• The Quake Select Flex Limit product offers a flexible limit product with customizable options for each coverage (Dwelling, Other Structures, Personal Property, and Loss of Use) and a range of deductibles from 2.5-25% which is applied separately to each coverage.

• GeoVera’s Single Limit product, with a combined single limit for all coverages and one deductible (10-25%), includes demand surge and the option not to rebuild.

Moving Forward

Rebuilding after an earthquake is a daunting task, but a transparent and efficient claims process can significantly ease this burden. GeoVera’s goal is to provide exemplary claims service to our policyholders and agent-partners in their time of need. Our success formula centers on timely communication and a dedication to keeping insured clients, agents, and support team stakeholders well-informed. By understanding the steps involved and preparing accordingly, policyholders can navigate their claims with confidence, ensuring a fair settlement and a path toward recovery.

Remember, the goal of earthquake insurance is to help you rebuild your life. With the right preparation and knowledge, handling your earthquake insurance claim can be a straightforward and constructive process.

Please make sure your family and friends are prepared. An earthquake can happen anytime, and our goal is to educate our customers and their loved ones