The L.A. Times recently published “What’s New In Earthquake Preparedness” and suggested that high insurance premiums may rise further due to increased labor and construction costs. And this might be the fundamental reason why so many homeowners in California (fewer than 1 in 7) do not have earthquake insurance.

However, GeoVera Chief Executive John Forney indicates the primary cause of the low adoption rates of earthquake insurance by homeowners is human nature rather than high cost:

[….] Forney said he doubted that price was the real issue, given the emergence of coverage options that can bring premiums down. He suggested that a bigger factor was human nature, or the natural desire “to think it’s not going to happen to you.”

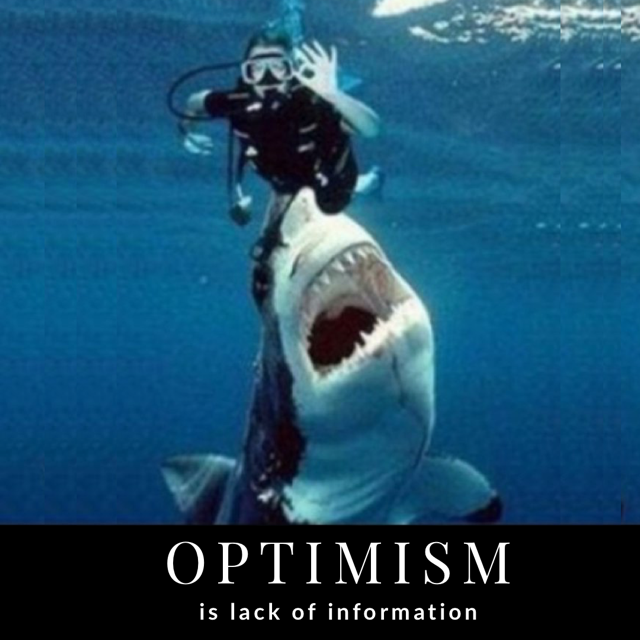

In fact, we know humans are not good at assessing their own risk because of optimism bias. Optimism bias particularly comes into play with events that don’t occur frequently, which is exactly the case in catastrophic events like major earthquakes.

So, how do we help homeowners overcome optimism bias? First, you spread awareness for Earthquake insurance every chance you get. Second, you offer an Earthquake quote to every homeowner at every renewal, and third, you require your client’s signature to decline Earthquake coverage. Soon, more homeowners will be covered, and Earthquake insurance in ‘Earthquake Country’ will become “the norm”.

The Top 3 Reasons You Must Offer Earthquake Insurance to Every Homeowner:

The earthquake insurance experts at GeoVera reveal the top three reasons it is critical for your agency to offer earthquake insurance to every homeowner:

- Earthquake insurance fills a very real coverage gap for your clients.

Not only for California homeowners but also for every homeowner in higher-risk fault areas like Washington state and Oregon. Typical homeowners insurance policies do not cover earthquake damage, and FEMA grants are not meant to take the place of earthquake insurance. Most people are not financially able to bear the loss of a home, rebuild that home, and still pay off their mortgage at the same time. - Offering Earthquake insurance provides Errors and Omissions Insurance (E&O) protection for your agency.

Your clients come to you as an expert in home insurance. Therefore, you must educate them on their risks and liabilities, including that earthquake coverage isn’t automatic with the standard Homeowners insurance policy. In addition, in our increasingly litigious society, you do not want to risk the possibility of a client suing your agency because you did not inform them of their earthquake loss risks. - Earthquake insurance & bundled policies have a very high retention rate.

Earthquake insurance has a high retention rate; over 95% of policies renew annually. As home equity grows and the risk of a devastating earthquake also grows over time, an earthquake policy is considered to increase in value, year after year. It is also evident that when more policies are bundled for a client, this dramatically improves the retention rate for every bundled policy. GeoVera’s Earthquake product is the perfect solution to help increase retention rates for all your accounts.GeoVera is available on the most popular comparative raters, PL Rating, EZ Lynx, Bolt, and more to make it easier for agents to bundle Earthquake insurance. Agents can get fast and accurate earthquake quotes from the top-rated provider in the marketplace and bundle with a Home & Auto quote for every client.

The risk of earthquakes and their financial toll should be top of mind for every insurance agent and homeowner in California, Oregon, and Washington. Most homeowners have not experienced a devastating catastrophe that occurs every 100, 200, 300 or more years. That is why it’s more important than ever to be prepared! You’ll want GeoVera on your side when the next quake strikes.